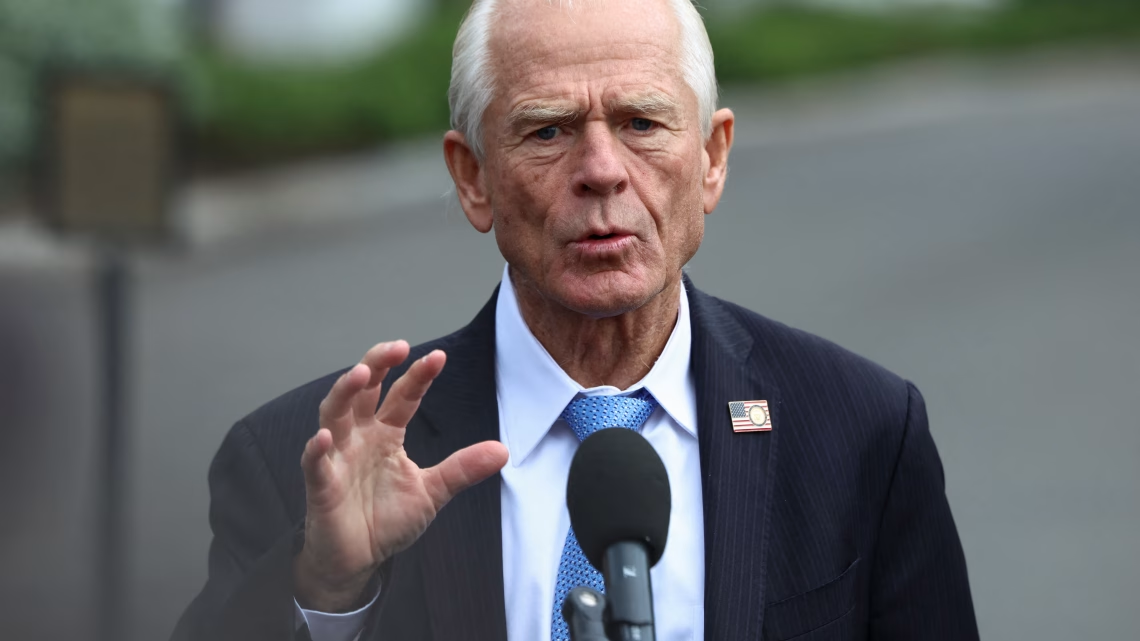

White House Adviser Navarro Renews Tirade against India’s Russian Oil Imports

September 8, 2025 Off By Sharp MediaWhite House adviser Peter Navarro again attacked India for buying Russian crude, saying New Delhi buys only to make profit and calling India an oil money washing shop for Moscow. His posts on X were checked by Community Notes, which noted that India’s oil trade is driven by energy need and kept within set rules, and also reminded readers that the United States still buys some Russian goods, including uranium. The row comes as new United States duties on Indian goods raise costs on many export lines and add fresh strain to ties. The issue now is the price India is paying for a mixed policy line under the Modi government that brings loud words at home but more pressure abroad.

• Core point: Navarro’s harsh words meet public checks but still shape global mood.

• Trade backdrop: Extra duties in the US raise costs for Indian exporters.

• Policy test: India needs a clear plan that protects jobs and keeps prices stable.

Navarro’s Charge and Public Facts

Navarro says India fuels Russia’s war by buying cheap oil for gain, but public notes under his posts point to allowed trades under the price cap system and to US imports from Russia that still continue. Even with these facts, a senior US voice can move markets and make buyers more careful.

• Harsh claim: India is called a profit seeker that helps Moscow.

• Facts in view: Purchases follow set rules and price caps.

• Real effect: Such posts raise risk for Indian trade and talks.

Tariffs and Strain on Exports

A new extra duty tied to crude flows sits on top of earlier slabs, and for many items the total hit is now close to fifty percent. Exporters report slower orders and longer payment cycles, while small units in textiles, leather, and light engineering face thin margins and job stress.

• Two duty slabs: Old and new levies push prices up for buyers.

• Order slump: Clients cut or delay orders to avoid higher costs.

• Jobs at risk: Small factories carry the main pain when cash runs tight.

India’s Energy Need and the Law

India is the third largest oil buyer and must keep steady and cheaper supply to shield transport, farms, and basic prices. Since 2022, discounted Russian barrels helped hold pump rates and gave refiners room to run plants and pay debt. These trades have stayed within allowed routes, so the claim that India is breaking law does not match the record.

• Large demand: Daily oil need is high across roads, farms, and industry.

• Price cushion: Cheaper crude helped tame inflation and protect jobs.

• Rule bound: Payments and shipping followed allowed paths.

Russia’s Share and the Numbers

Russia is now India’s top crude source. By 2024 its share touched nearly thirty five percent, up from near zero before the Ukraine war, and flows reached about 1.8 million barrels per day at peaks last year. This shows why any sudden cut would hurt the market and why a careful shift needs time.

• Top share: Russia leads India’s crude mix.

• High volumes: Imports neared 1.8 million barrels a day at peaks.

• Hard to switch: A fast exit would bring price spikes at home.

Double Standards and Falling Trust

Community Notes also flagged that the United States still buys some Russian goods while pressing others to stop, which reads as one rule for some and another for others. This weakens one sided blame and pushes partners to hold back until rules look even.

• Mixed practice: Some US buys from Russia still continue.

• Weak case: One sided pressure loses moral force.

• Trust gap: Uneven rules push partners to wait and watch.

Modi Government’s Mixed Policy Line

The Modi government says India follows an independent policy, yet the pattern of fast praise, sharp replies, and few public details looks tactical, not planned. A steady path would set targets to lower Russia’s share, list new sources, and seek duty relief and tech access from the United States in return. Instead, show at home has outpaced homework abroad.

• Noise over plan: Posts and speeches outrun clear road maps.

• No targets: There is no public schedule to cut Russia risk.

• Blowback: Duties and rows now shape the trade climate.

Refining, Jobs, and Everyday Prices

India’s refineries work like other hubs in the Gulf and Europe. They buy crude at the best rate, sell fuel at home and abroad, and the spread between crude cost and product price keeps plants alive and workers paid. Calling this a money washing shop ignores how refining works and shifts the debate away from the real task of changing shares without hurting pump prices or jobs.

• Normal model: Hubs live on the crude to fuel margin.

• Jobs link: Fuel exports bring foreign cash and support local work.

• Policy lever: Shares can be moved in steps with care.

Market Risk and India’s Image

Harsh words and rising duties lift risk on Indian cargoes and push banks and insurers to raise prices. Buyers think twice before long deals when they fear new shocks. In South Asia and beyond, rivals use the noise to say India is not steady, which hurts its standing.

• Higher risk: Loans and cover get costlier under uncertainty.

• Buyer caution: Clients delay deals to avoid shocks.

• Image cost: Noise harms India’s claim of stable policy.

What New Delhi Should Do Now

India needs a public plan that lowers the Russia share without a fuel shock at home. New Delhi should seek a duty pause with Washington tied to clear steps on crude sources, and it should lock mid term supply from West Asia, the United States, and Africa to spread risk. At home, rules should make sure gains from cheaper crude reach consumers and small firms through lower pump and freight costs.

• Set targets: Publish quarterly goals to trim the Russia share while keeping prices steady.

• Duty pause: Negotiate a halt on new levies in return for open steps on sourcing.

• Secure barrels: Sign supply deals with many sellers to cut risk.

• Pass gains: Ensure cheaper crude lowers fuel and freight rates.

Conclusion

Navarro’s harsh words found space because the Modi government has not set out a clear oil plan and has let trade ties with the United States slide into loud fights and heavy duties. India does need cheap energy and has kept within set rules, yet that alone will not calm markets or partners. The way forward is not more noise, it is steady work that cuts risk, protects jobs, and builds trust through steps that people at home and friends abroad can see and check. If New Delhi wants respect, it must move from headlines to homework and match each claim with a public step that holds over time.

• Main message: India needs a clear oil plan, not daily online rows.

• Near term fix: Freeze the duty fight and publish a steady shift in crude sources.

• Proof of success: Cheaper fuel, stable exports, and fewer shocks from partners.