India: A Risky Option for Investment Due to Rampant Fraud and Corruption

August 1, 2024 Off By Sharp MediaDespite India’s claims of being one of the world’s fastest-growing economies and a magnet for foreign investment, the reality reveals a much darker picture. The Indian corporate sector is plagued by extensive financial fraud, cybercrime, and corruption, posing significant risks to investors.

According to PwC’s Global Economic Crime and Fraud Survey 2022, 52% of Indian organizations experienced some form of fraud. This alarming statistic underscores the prevalence of fraudulent activities in India’s business environment, which can have severe consequences for stakeholders and potential investors.

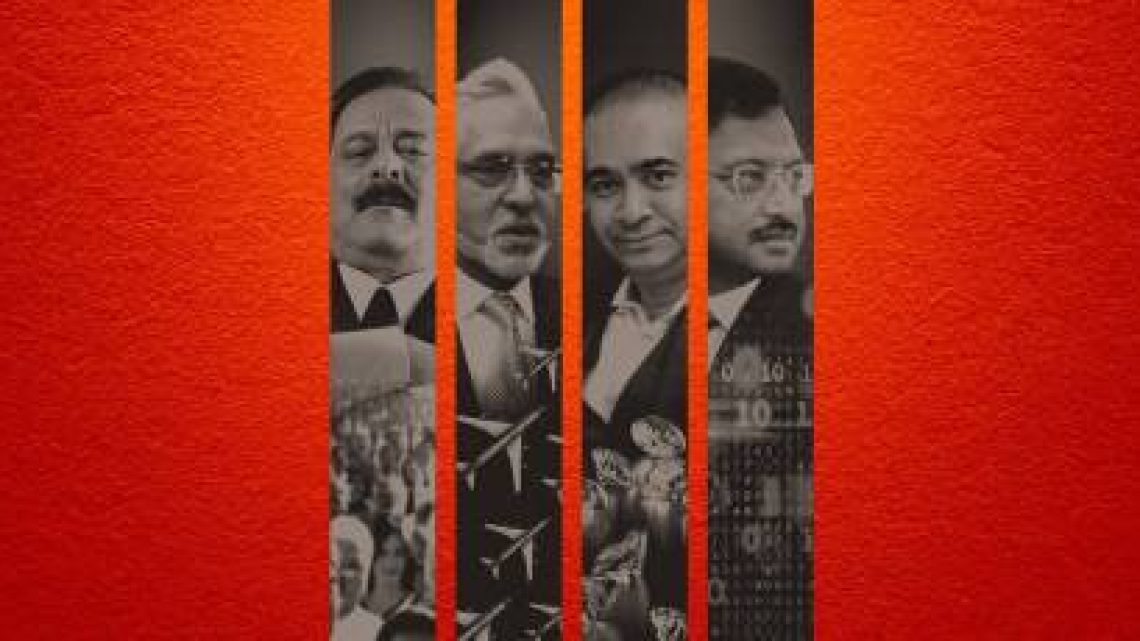

One prominent case is the Qatar Investment Authority (QIA) issue. QIA, a major foreign investor in India, invested heavily in Byju’s in 2019 and 2022. However, Byju’s has since reported significant losses due to fraudulent activities by its founder, Byju Raveendran. The QIA has taken legal action, seeking to recover up to $235.19 million from Raveendran’s personal assets, highlighting the risks foreign investors face in India.

Another major scandal was the Nirav Modi scam, which involved fraudulent transactions exceeding $2 billion. This scandal severely impacted Punjab National Bank and shook investor confidence in India’s financial sector.

The Satyam scandal further exposed weaknesses in corporate governance in India. The significant accounting fraud led to the collapse of Satyam Computer Services, once a major player in the IT industry, and raised serious concerns about the integrity of Indian businesses.

Recent trends have also shown a rise in investment scams through social media platforms like WhatsApp and Telegram, targeting unsuspecting investors. These scams add to the growing list of reasons why investors are increasingly wary of investing in India.

The financial losses from such frauds can be enormous, sometimes reaching millions of dollars. Despite regulations like the Prevention of Money Laundering Act (PMLA) and the Companies Act, enforcement remains weak. Many fraudsters continue to evade detection, and Indian authorities have struggled to apprehend and charge those responsible.

Compared to countries like Singapore and Hong Kong, which have more robust anti-fraud measures, India’s regulatory framework is lacking. This makes alternative markets more attractive to potential investors who seek a safer and more secure investment environment.

India’s ongoing challenges with fraud and corruption make it a risky investment destination. Until the Indian government takes more effective action to combat these issues, investors may continue to look elsewhere for safer opportunities.